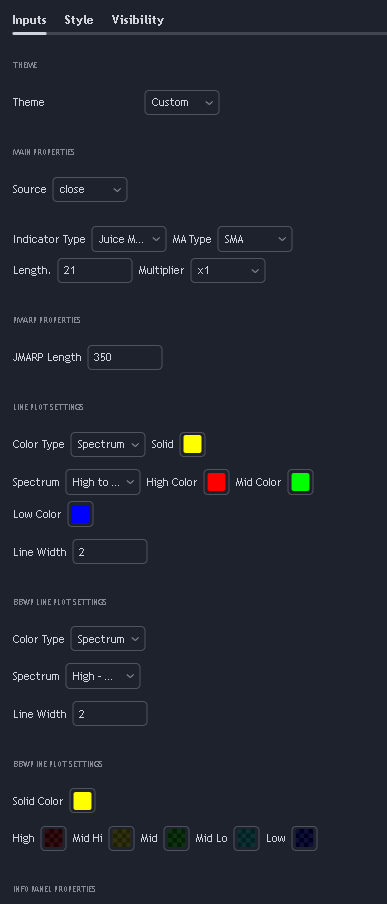

BBWP+MAR(P)

Bolinger Band Width Percentile and Moving Average Range (Percentile)

Bolinger Band Width Percentile and Moving Average Range (Percentile) helps traders read market volatility.

By combining these indicators, traders can identify high-probability trading opportunities and manage risk effectively.

BBWP

Bollinger Band Width Percentile and RSI

Measures the width of the Bollinger Bands relative to historical levels, indicating market volatility. High percentile values signify increased volatility, while low percentile values suggest decreased volatility.

RSI (Relative Strength Index) with Divergence Alerts

The RSI is a momentum oscillator that measures the speed and change of price movements. Divergence alerts highlight discrepancies between the RSI and price movements, signaling potential trend reversals.

MAR(P)

Moving Average Ratio (Percentile)

Compares the current price to its moving average over a specified period, assessing trend strength. High percentile values indicate a strong uptrend, while low percentile values indicate a strong downtrend.

Similar to RSI divergence alerts

MAR(P) divergence alerts highlight discrepancies between the Moving Average Ratio Percentile and price movements. This helps traders identify potential trend reversals or continuations based on the relationship between price and its moving average.